Do you have a keen interest in delving into the world of stock market investments but find yourself uncertain about the initial steps? Look no further, as eToro offers a user-friendly platform that can serve as your guiding light to commence your journey into stock trading and the construction of a robust investment portfolio. Within the confines of this comprehensive guide, we shall intricately lead you through the intricate process of acquiring stocks on eToro, unraveling each step with meticulous care and clarity.

Establishing Your eToro Trading Account

Introduction to Account Creation

To embark on your journey with eToro, the first essential step is to establish your own trading account. This is a straightforward process that starts with a visit to eToro’s official website. Here’s a step-by-step guide to navigate through the account setup:

- Accessing the eToro Website: Upon reaching the eToro homepage, locate the options for account registration, typically labeled as “Join Now” or “Sign Up”;

- Filling in Personal Details: The registration process will prompt you to input various personal details. This information is critical to personalize and secure your account;

- Completing Registration: Follow through with the on-screen instructions to complete the registration phase. It’s essential to ensure that all provided information is accurate and up-to-date.

Tips for Account Creation:

- Choose a Strong Password: Opt for a password that is a combination of letters, numbers, and symbols to enhance security;

- Email Verification: Ensure the email provided is active, as you’ll receive important communications and verification links through it.

Identity Verification Process

Understanding the Verification Necessity

As a regulated financial platform, eToro mandates an identity verification process for all its users. This step is crucial to comply with legal requirements and enhance the security of your transactions.

Steps for Identity Verification:

- Proof of Identity: You will be required to upload a government-issued identification document. This could be your passport, driver’s license, or any other official ID;

- Proof of Residence: Alongside your ID, eToro requires proof of your current residential address. This is typically verified with a recent utility bill or a bank statement;

- Recommendations for Smooth Verification;

- Clarity of Documents: Ensure that all uploaded documents are clear and legible. Blurry or obscured information can delay the verification process;

- Up-to-Date Information: The documents provided should be current, preferably issued within the last few months;

- Follow Guidelines: Adhere strictly to the guidelines provided by eToro regarding the formats and types of documents accepted.

Additional Insights

- Privacy and Security: eToro places high importance on the privacy and security of your personal information. All data submitted is encrypted and protected;

- Customer Support: In case of any difficulties during the account setup or verification process, eToro’s customer support team is readily available to assist;

- Regulatory Compliance: Understand that these steps are in place not just for the platform’s security but also to align with global financial regulations, ensuring a safe trading environment for all users.

Capitalize Your Account

After receiving confirmation that your account is operational, the next phase involves injecting capital into your eToro account. This step is crucial as it empowers you to begin trading. eToro offers a spectrum of deposit options to cater to diverse preferences and needs. These include:

- Credit/Debit Cards: A swift and convenient method for many users;

- Bank Transfers: Ideal for those preferring traditional banking methods;

- E-Wallets: Options like PayPal and Skrill for modern, digital-savvy users.

When selecting a deposit method, consider factors such as transaction speed, fees, and convenience. Follow these steps to add funds:

- Log into your eToro account;

- Navigate to the ‘Deposit Funds’ section;

- Select your preferred payment method;

- Enter the amount you wish to deposit.

Follow the on-screen instructions to complete the transaction.

Tips for Funding Your Account:

- Ensure your chosen method matches your investment strategy in terms of deposit limits and processing times;

- Check for any transaction fees that might apply;

- Consider starting with a modest amount to familiarize yourself with the platform.

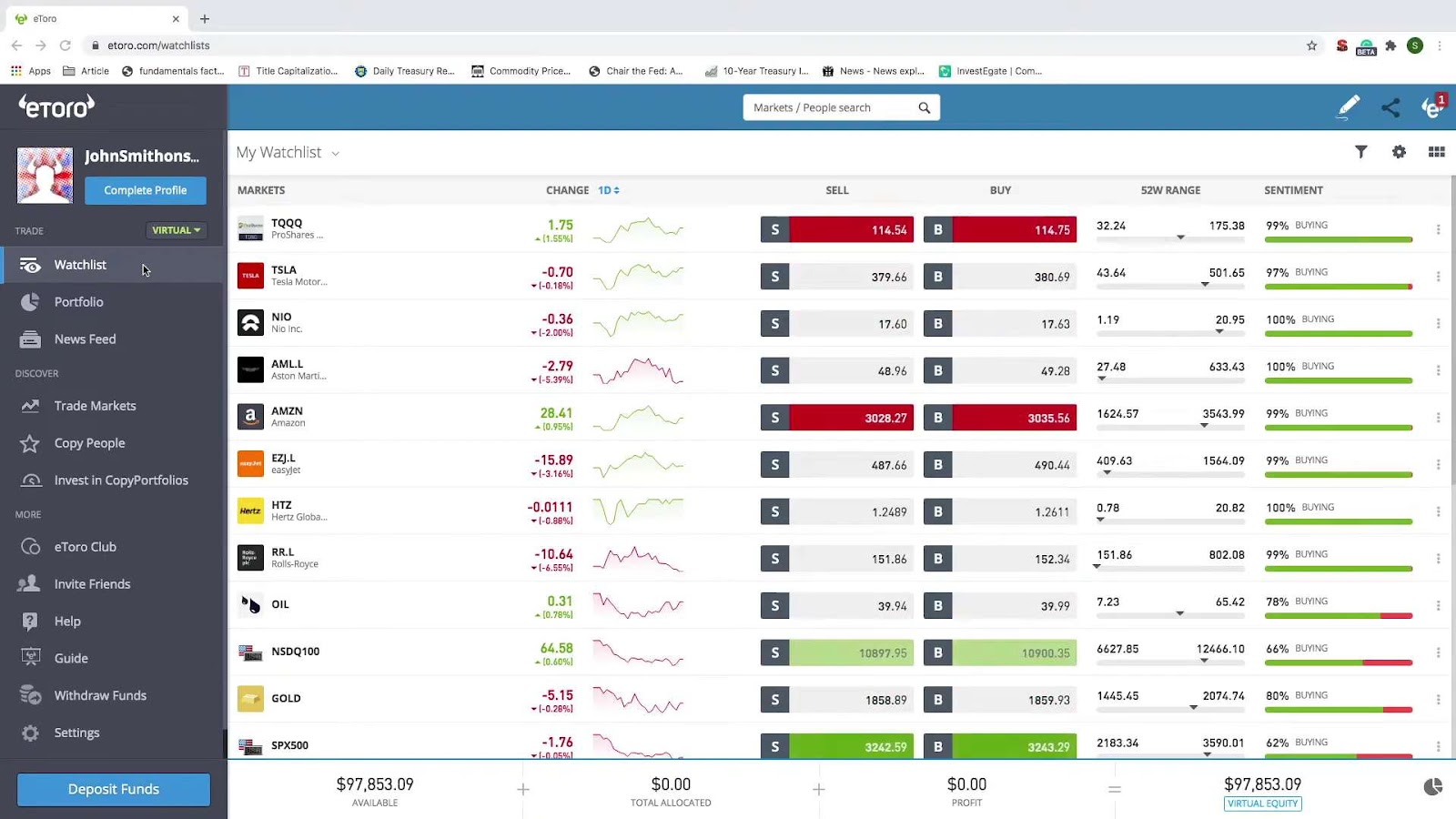

Commence Your Stock Discovery

With your account now primed with funds, you are set to embark on the journey of stock selection. eToro’s platform simplifies this process with its user-friendly interface. Here’s how you can explore potential investments:

- Utilize the search function at the platform’s top to pinpoint stocks;

- You can search using various criteria, such as the company’s name, its ticker symbol (a unique identifier for publicly traded shares), or by industry.

To enhance your stock searching experience, consider the following strategies:

- Define Your Investment Goals: Understand what you’re looking for – long-term growth, dividends, or short-term gains;

- Research Thoroughly: Look into the company’s fundamentals, recent news, and performance history;

- Explore Industry Trends: Identifying industries with growth potential can lead to fruitful investments;

- Use Filters: eToro offers filters to narrow down choices based on your preferences like market cap, P/E ratio, and others.

In-Depth Stock Analysis

Conducting a thorough examination of a stock prior to investing is crucial. Utilize platforms like eToro which offer a plethora of resources to assist in this process. Here are key elements to focus on during your analysis:

- Historical Price Trends: Review the stock’s price fluctuations over different periods. This includes short-term, mid-term, and long-term trends. Understanding these trends can offer insights into the stock’s stability and growth patterns.

- Current News and Developments: Stay updated with the latest news and events related to the stock. This includes corporate announcements, market news, and sector-specific developments. These factors can significantly influence a stock’s performance.

- Analyst Opinions and Forecasts: Pay attention to what market experts and financial analysts are saying about the stock. Their forecasts, ratings, and recommendations can provide valuable perspectives on the stock’s future prospects.

- Financial Health and Company Performance: Examine the company’s financial statements. Look for profitability, revenue growth, debt levels, and other financial health indicators.

- Market Sentiment and Investor Behavior: Understanding how other investors perceive the stock can be beneficial. This includes looking at trading volumes and market sentiment indicators.

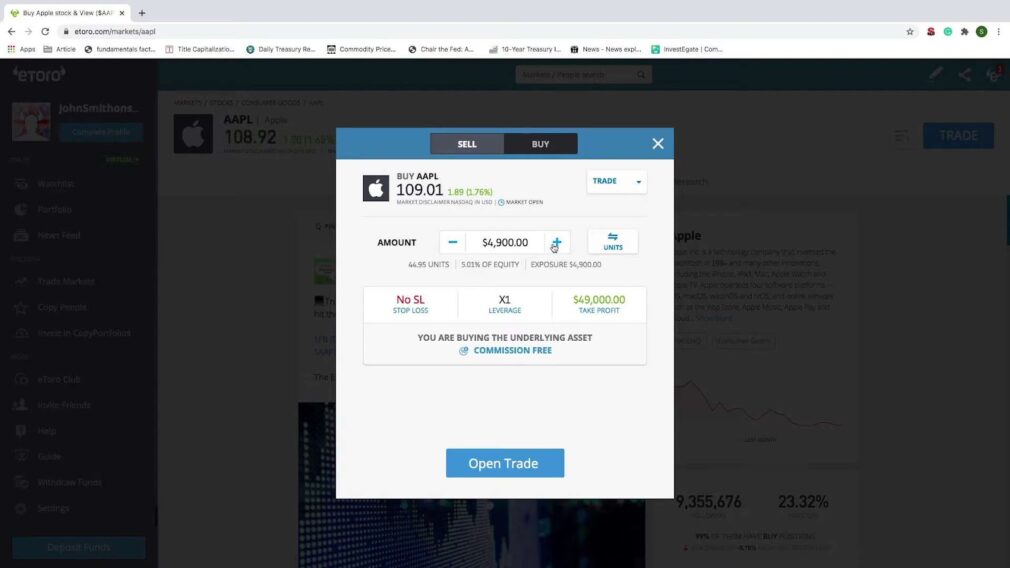

Executing a Stock Purchase

After a thorough analysis and deciding on a particular stock, the next step is to initiate a purchase. Here’s a guide to placing an order:

- Accessing the Trading Page: Navigate to the specific stock’s page on your chosen trading platform. This is where all relevant trading actions are executed;

- Initiating a Trade: Locate and click on the “Trade” or “Buy” option. This action opens the transaction interface.

Setting Investment Parameters:

- Investment Amount: Decide and enter the amount of money you are willing to invest in the stock;

- Stop-Loss and Take-Profit Levels: These are crucial risk management tools. A stop-loss order limits potential losses by setting a price at which the stock will be automatically sold if it drops too low. Conversely, a take-profit order specifies a price at which the stock will be sold to secure profits;

- Order Type: Choose between market orders (buying at the current market price) or limit orders (setting a future price at which you wish to buy).

Confirm Your Order

Before finalizing your investment, it’s crucial to meticulously review your order details to ensure a smooth and well-informed decision. Take your time to double-check everything before confirming your purchase. Here’s a comprehensive guide on how to make this step as effective as possible:

- Verify Investment Amount: Confirm that the amount you’re investing aligns with your financial goals and risk tolerance. Make sure it’s an amount you’re comfortable with;

- Check Order Settings: Pay close attention to the order settings, such as the type of order (market, limit, or stop-loss), expiration date (if applicable), and any special instructions. Ensure these settings are in line with your trading strategy;

- Verify Stock Selection: Review the stock you’re about to purchase. Is it the right asset that aligns with your investment objectives? Consider factors like the company’s financial health, growth potential, and recent performance;

- Confirm Fees and Commissions: Be aware of any transaction fees or commissions associated with your order. Understanding these costs is essential for calculating your potential returns accurately;

- Risk Assessment: Evaluate the risk associated with the investment. Consider the stock’s historical volatility, market conditions, and any recent news that might impact its price;

- Click “Open Trade”: Once you’ve thoroughly reviewed and are comfortable with all the above aspects, confidently click the “Open Trade” button to execute your order.

Monitor Your Investment

Your journey as an investor doesn’t end with the purchase; it’s just the beginning. After acquiring the stock, you’ll need to actively monitor its performance to make informed decisions. Here’s how to effectively keep an eye on your investment:

- Set Up Alerts: Utilize eToro’s alert system to get notifications for price changes, news updates, and any significant developments related to your investment;

- Regular Portfolio Check: Make it a habit to check your eToro portfolio regularly. Track how your investment is performing over time and compare it to your expectations;

- Stay Informed: Stay updated with the latest news and market trends that could impact your stock’s value. Knowledge is your most valuable asset in making informed investment decisions;

- Review Performance Metrics: Analyze key performance metrics like price-to-earnings ratio, earnings per share, and dividend yield. These can provide insights into the stock’s health and potential;

- Consider Stop-Loss Orders: If you want to limit potential losses, consider setting up stop-loss orders. These automatically sell your stock if it reaches a predetermined price, protecting your investment.

Consider Diversification

Diversifying your investment portfolio is a critical strategy for mitigating risk and maximizing potential returns. eToro offers a vast array of investment opportunities from various industries and regions. Here’s how to harness the power of diversification:

- Asset Variety: Explore eToro’s diverse range of assets, including stocks, ETFs, cryptocurrencies, commodities, and more. Diversification isn’t limited to stocks alone;

- Industry and Sector Allocation: Spread your investments across different industries and sectors. This reduces your exposure to downturns in any single sector;

- Geographic Diversification: Consider investing in companies from different regions and countries. This can help protect your portfolio from regional economic fluctuations;

- Risk Tolerance Assessment: Align your diversification strategy with your risk tolerance. More conservative investors may lean towards a broader diversification approach;

- Rebalance Periodically: Regularly review and rebalance your portfolio to maintain your desired asset allocation. As some assets perform better than others, your original allocation may shift;

- Professional Advice: If you’re unsure about diversification, consider consulting with a financial advisor or utilizing eToro’s educational resources to make well-informed decisions.

By following these steps and strategies, you can enhance your investment journey on eToro, making it not only profitable but also an educational and fulfilling experience.

Conclusion

eToro offers a user-friendly interface for purchasing and trading stocks. By adhering to the instructions laid out in this comprehensive guide, you can embark on your path as an investor and create a well-balanced investment portfolio. It’s essential to emphasize the importance of thorough research, prudent risk management, and staying abreast of market trends to ensure that your investment choices on eToro are well-informed. Wishing you profitable ventures in your investment journey!