Cryptocurrency markets are dynamic and rich with various digital assets, each offering unique features and communities. Among these is Bonk (BONK), a cryptocurrency that has attracted attention in the crypto space. If you’re looking to join the Bonk bandwagon, this step-by-step guide will walk you through the process of purchasing BONK.

What is Bonk (BONK)?

Before diving into the buying process, it’s crucial to understand what Bonk is. Bonk (BONK) is a type of cryptocurrency. Like other cryptocurrencies, it operates on blockchain technology, offering decentralized, secure, and often rapid transactions. Specific details about Bonk, such as its unique features, market position, and technology, can help potential investors make informed decisions.

Comprehensive Guide to Purchasing Bonk

The world of cryptocurrency is dynamic, with platforms like Binance constantly updating their offerings. For those interested in purchasing Bonk, which is not currently available on Binance, this guide provides a clear roadmap.

One effective approach is to explore other reputable centralized exchanges. Websites like Coinmarketcap.com are excellent resources for discovering where Bonk is listed. Their ‘Markets’ section provides a comprehensive list of exchanges, offering a straightforward way to find a suitable platform.

For a more decentralized approach, consider using a decentralized exchange (DEX). This method involves using your Binance account to acquire the base currency and then connecting your crypto wallet to a DEX that supports Bonk’s blockchain. This guide will walk you through each step of this process, ensuring a smooth and informed transaction.

Guide to Setting Up a Trust Wallet for Solana Transactions

In the realm of Solana-based cryptocurrencies, numerous wallet options are available, with Trust Wallet being one of the most seamlessly integrated choices. Whether you’re working on a desktop or prefer mobile access, setting up Trust Wallet is straightforward.

- To start on a desktop, first install the Google Chrome browser;

- Then, proceed to add the Trust Wallet extension, which is available in the Chrome Web Store;

- For those using mobile devices, the Trust Wallet application can be downloaded from the Google Play Store for Android users or the iOS App Store for Apple device users;

- It is highly important to download these applications straight from the official Trust Wallet website to guarantee their security and authenticity;

- Taking this step is essential to steer clear of unofficial or potentially malicious versions.

Initial Setup of Trust Wallet

- Begin by configuring your Trust Wallet, either through the Google Chrome extension or the mobile app you installed previously;

- For detailed guidance, you might find the wallet’s support page useful;

- During this setup, you’ll receive a seed phrase – it’s crucial to keep this secure as it’s key to your wallet’s security;

- Also, make a note of your wallet address; it will be important in later steps.

Purchasing SOL as Your Primary Cryptocurrency

- With your Trust Wallet ready, the next step is to acquire SOL, the base currency for your transactions;

- Log into your Binance account and navigate to their Crypto webpage to make the purchase;

- If you’re new to Binance, they provide a comprehensive guide on how to register and buy your first cryptocurrency.

Transferring SOL from Binance to Your Personal Wallet

- After acquiring SOL on Binance, navigate to your Binance wallet section to locate your SOL holdings;

- Initiate a withdrawal by filling in the necessary details;

- Ensure that you select the Solana network for the transfer;

- Input your personal wallet address and specify the amount of SOL you wish to transfer;

- Once you confirm the withdrawal, the SOL will be processed and sent to your Trust Wallet.

Choosing an Appropriate Decentralized Exchange (DEX)

In the realm of digital asset exchange, a myriad of decentralized exchanges (DEXs) is at your disposal. It’s pivotal to choose a DEX that is compatible with the digital wallet you have already configured. For example, if your choice was Trust Wallet, a trading platform such as Raydium could be an appropriate option for carrying out your transactions. This stage is about ensuring that your wallet and the selected DEX work seamlessly together, paving the way for an efficient trading experience.

Linking Your Digital Wallet

Initiate the process by creating a connection between your chosen digital wallet and a decentralized exchange (DEX) that suits your needs. This crucial step is integral to participating in various cryptocurrency-related activities and necessitates using the specific wallet address that you have previously obtained. It’s important to verify the compatibility of your wallet with the DEX, and to adhere to prescribed security protocols to establish a secure link. This connection is vital for effectively managing your digital assets and engaging in activities like trading, exchanging, or utilizing other blockchain-related services. Always ensure the accuracy of your wallet address to avoid any mistakes in transactions.

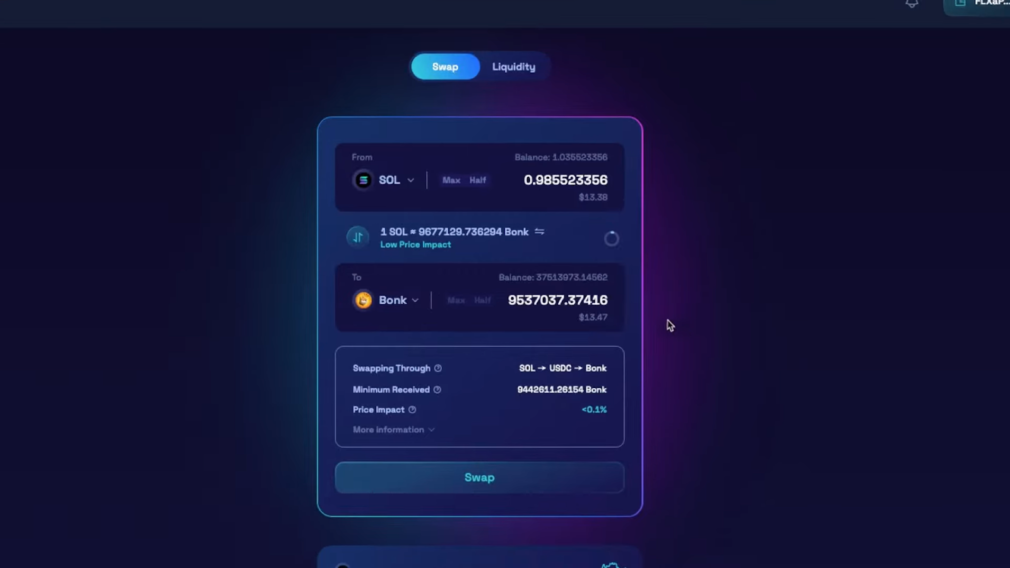

Exchanging Cryptocurrency

Embark on the process of exchanging your current cryptocurrency holdings, such as SOL, for a different type of digital currency of your choice, like Bonk. This step involves navigating the trading interface of your chosen decentralized exchange (DEX), where you’ll select the cryptocurrency you currently possess and specify the one you intend to acquire. The process is not limited to just SOL and Bonk but can encompass a wide range of cryptocurrencies, allowing for diverse trading opportunities. It’s essential to be aware of the exchange rates, transaction fees, and market trends impacting the cryptocurrencies involved. This careful selection ensures that you make informed decisions while diversifying or consolidating your digital asset portfolio. Keep in mind that the volatility of the crypto market requires a strategic approach to maximize benefits and minimize risks in these transactions.

Locating Unlisted Cryptocurrencies

In situations where your targeted cryptocurrency is not readily available on your chosen decentralized exchange (DEX), it’s advisable to explore a blockchain explorer site tailored to the specific blockchain, like Solana’s explorer for Solana-based tokens. These explorers serve as comprehensive databases where you can search for and identify the smart contract address of the desired cryptocurrency. Once located, this address can be used on various trading platforms, such as Raydium, to engage with the cryptocurrency directly. It’s crucial to exercise due diligence in this process, ensuring the authenticity of the smart contract address. Verifying its legitimacy is key to avoiding fraudulent schemes and securing your investments. This approach not only opens up access to a broader range of digital currencies but also empowers you to navigate the crypto ecosystem more effectively, especially when dealing with emerging or less-known cryptocurrencies.

Completing the Transaction

Once you’ve navigated through the preliminary steps, including linking your wallet and selecting your cryptocurrencies, the final action is to confirm the transaction. This is done by clicking the “Swap” button on the platform interface. This crucial step initiates the exchange process, transforming your selection into a completed transaction. It’s the culmination of your careful planning and decision-making, from the initial choice of a cryptocurrency source to the final acquisition. This action finalizes the exchange, effectively transferring ownership of the digital assets and updating your wallet balance. It’s important to review the transaction details for accuracy before confirming, as this action is typically irreversible. Successfully executing this step marks the completion of your cryptocurrency transaction, reflecting your active participation in the dynamic world of digital currency trading and investment.

Monitor Your Investment

- Active and informed management of your Bonk (BONK) investment is a critical aspect of engaging with the cryptocurrency market, known for its dynamic and often unpredictable nature. It is advisable not to simply purchase and forget your investment, but to regularly monitor its progress. This involves more than just checking the price; it includes staying updated on market trends, news, and developments related to Bonk and the broader crypto world;

- Utilize the array of tools and analytical resources offered by your chosen cryptocurrency exchange. These can include price alerts, historical performance charts, and market analysis reports. They serve as valuable aids in understanding market movements and the factors influencing them;

- In addition to using exchange tools, consider engaging with online cryptocurrency communities, forums, and news platforms. This will provide a broader perspective on the factors affecting Bonk’s value and the cryptocurrency market in general. It’s also a way to connect with other investors and gain insights from their experiences and strategies.

As you monitor your investment, be prepared to make decisions about buying more, holding, or selling based on your financial goals and market analysis. Diversifying your portfolio by investing in different cryptocurrencies or other assets can also be a smart strategy to manage risk. After delving into the process of buying Bonk (BONK), let’s now turn our attention to a concise guide on purchasing Maker Coin, another key player in the cryptocurrency market.

Conclusion

Purchasing Bonk, like any investment, requires careful consideration and planning. By following these steps, you can ensure a smoother, more informed entry into the world of Bonk and cryptocurrency trading. Always remember to invest responsibly and consider consulting a financial advisor for personalized advice.